Housing Demand Remains Strong As Mortgage Rates Tumble To Another Historic Low

The average 30-year fixed mortgage rate dropped to 2.67% this week, down from 2.71% the previous week.

The historically low borrowing rates continue to drive a boom in the housing market.

The applications for refinances and home purchases have been increasing on a weekly and annual basis.

Experts expect the market to experience continued growth and price escalation heading into 2021.

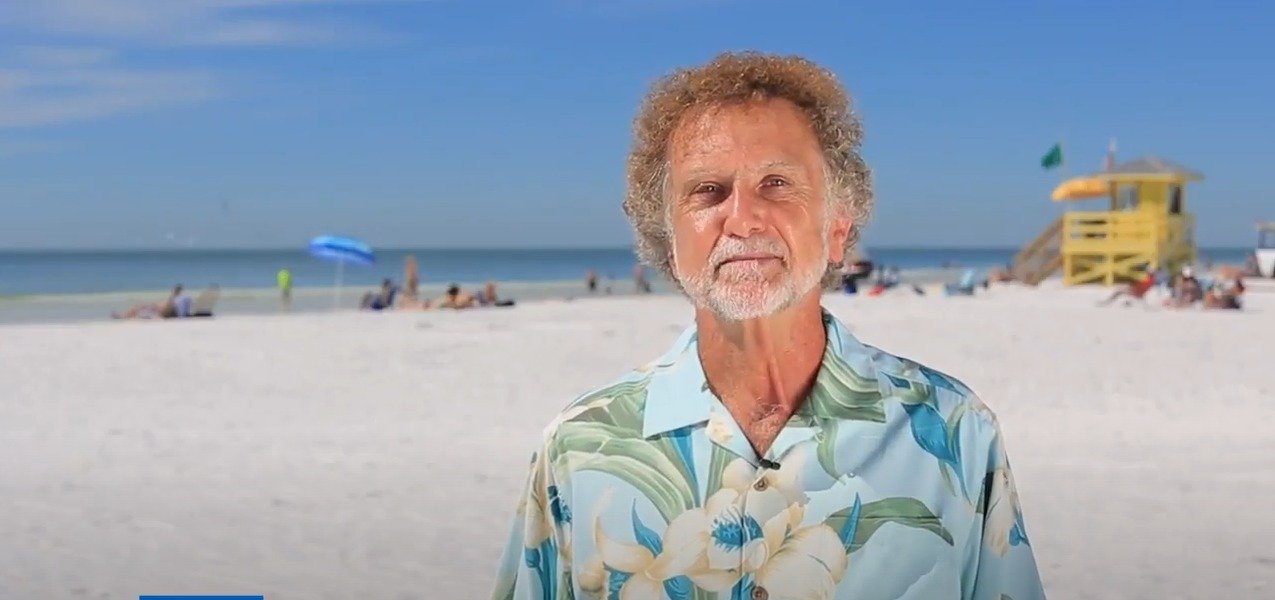

“The demand for houses has overwhelmed the available inventory here in metro Detroit and in metro areas across the country,” said James Yugovich, The Yugovich Group - eXp Realty. “As interest rates remain low, buyers are moving forward in record numbers... Continued strength and price accelerations in the market should be expected.”

The real estate market is heavily dependent upon how the mortgage rates play out. Luckily, the mortgage rates have been on a decline, and in 2020, it dropped to their historic low for the first time in 30 years. According to the data released by Freddie Mac, the average rate in the real estate market, which had been fixed for the past 30 years, fell to 2.67 %. Just about a week ago, it was 2.71 % and 3.73% a year ago. The 30-year fixed-rate has not reached such a low since 1971. It even dropped down from the previous low of 2.88 % just last month.

The low mortgage rates have helped to increase US house prices as demand for housing seems to have risen. According to Sam Khater, Freddie Mac’s chief economist, “Despite persistently low mortgage rates, home sales have hit a wall. While homebuyer appetite remains robust, the scarce inventory has effectively put a limit on how much higher sales can increase. Unfortunately, the record low supply combined with strong demand means home prices are rapidly escalating and eroding the benefits of the low mortgage rate environment.”

The above quote indicates that the drop in mortgage rates have fueled the demand for more houses. It has allowed affordability as more people find that they can pay the price of buying a house. However, one thing that has been affected is the supply. Buyers are facing a shortage of supply as suppliers want to put their homes on hold. This is happening for several reasons. According to the BBVA USA Head of Mortgage Banking Murat Kalkan, people are not putting up their houses for sale because the pandemic has interfered with their plans.

Furthermore, it is not that easy to find another place to live, especially given the shortage of houses. It is also more difficult to apply for a newer mortgage, given how strict the lenders' criteria are. Another option, according to Kalkan, is the concept of pricing. People are just waiting to see if the prices will increase even further because the demand for housing is increasing following the drop in the mortgage rates. It seems the real estate market has become unpredictable, and only time will tell which way the market will settle.

However, in recent times, the higher demand has resulted in recent improvements in the number of new listings. It seems that there might be some equilibrium in the real estate market soon. Furthermore, the number of mortgage applications increased in December. According to the Mortgage Bankers Association's latest data, the market composite index, which measures the total loan application volume, increased 2.9 percent in one week. The purchase index also increased from 3 percent the previous week and was 40 % than the last year.

According to Bob Brokesmit, the Mortgagers Banking Association President, the applications for refinances and home purchases have been increasing on a weekly and annual basis.